CPPI, or Constant Proportion Portfolio Insurance, is an investment strategy whose goal is to allow investment in risky assets (like stocks) while still guaranteeing a minimum level of capital at the end.

It helps you decide how much to put into risky assets and how much to keep safe. It does this dynamically, increasing your risky investments when things look good and reducing them when the market looks shaky.

CPPI was introduced to the investment world by Fischer Black and Robert Jones in 1987.

Let's say you have $100 today, and you absolutely need to have at least $100 in ten years for a specific project. How much of that money can you risk for a chance at higher gains in the meantime?

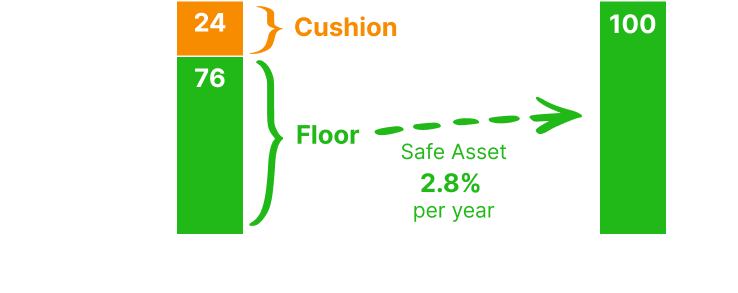

CPPI works by balancing your investments between two components:

This is the amount of money you can afford to risk, calculated as the difference between your total wealth and the floor (the minimum amount you want to safeguard).

A formula to calculate the Floor is:

where N is the number of remaining rebalancing periods.

Example: If your total wealth is $100 and your floor is $76, your cushion is $24

By allocating $76 to the safe asset earning a 2.8% annual return, you can ensure reaching $100 at the end of 10 years, regardless of market conditions.

The multiplier is a predetermined number that you multiply the cushion by to determine your exposure to the risky asset. It, therefore, dictates how aggressively you allocate your cushion to risky assets.

Example: With a multiplier of 3, you’ll invest three times your cushion ($24 × 3 = $72) in risky assets, while the rest ($28) remains in bonds.

You can invest more than your cushion in risky assets because extreme losses in a short time are rare. If such a loss occurs, the CPPI mechanism will reallocate your remaining wealth to the safe asset, preserving your floor.

In essence, the multiplier reflects how much risk you are willing to take:

By adjusting the multiplier, CPPI allows you to tailor your strategy based on your risk tolerance while maintaining a built-in safety mechanism.

CPPI lets you blend different assets to match your goals.

Safe assets offer protection, risky assets chase growth, and CPPI dynamically balances between them for a customized approach.

To better understand how CPPI works, we conducted a series of simulations using the following assumptions and parameters:

We ran simulations spanning January 1928 to December 2023, covering a wide range of market conditions. Each simulation involved:

For each combination of investment duration and multiplier, we ran simulations starting on the first day of every month. For instance:

This process was repeated for all possible combinations, resulting in more than 100,000 simulations. Such a comprehensive dataset allows us to evaluate how CPPI performs across various market conditions, including bull, bear, and flat markets.

Now that you know what CPPI is and how it works, why not explore if it’s right for you? CPPI might just be the strategy that protects your money while still giving you a shot at growth.

Remember: CPPI is just one of many strategies. Always choose the one that aligns with your financial goals and risk tolerance.